A lot of regulations around mortgages have changed since the 2008 financial crisis, which created healthier lending practices. That didn’t change the fact that many home buyers, not just first-timers, struggle to save enough for a 20% down payment. So do home buyers need 20% down to get a mortgage? This article touches on some pros and cons around the 20% threshold. However, how you handle your money is a personal decision and getting professional guidance is advised.

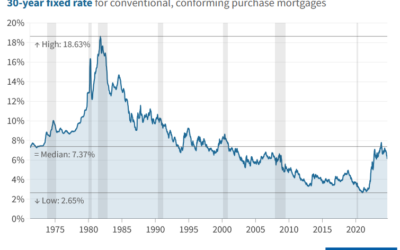

Mortgage Rates, High or Low?

I've always said, don't try to time the real estate market. The timing should depend on your personal scenario and readiness. Even for buyers that are looking at times that rates are increasing, there will be future opportunities to refinance when rates drop. Just a...